This article was originally published on Exchangewire on July 5, 2022

At ExchangeWire’s ATS London 2022, John Stoneman, Global Head of Demand at TripleLift addressed why the programmatic ecosystem must alter the narrative around change as it prepares for third-party cookie deprecation. Drawing on insights from TripleLift’s International Programmatic Buyer’s Journey survey, John discussed current quandaries with first-party data, buyer confidence in accurate targeting, and how the media buying journey must adapt for post-cookie environments.

Why are we seeing such a strong discrepancy between the perceived and actual accuracy of first-party data? What more can be done to encourage advertisers to embrace first-party data, particularly within programmatic?

In the UK, half of our survey respondents believed third-party data would be more accurate than its first-party counterpart. However, a study by Deloitte has revealed that targeting methods enabled by third-party cookies are only 30-40% accurate. At TripleLift, we’ve found first-party alternatives deliver at least double these accuracy rates at 70% or higher.

There is a need to wean marketers off the legacy system and demonstrate how first-party data can support their goals, even if it means the media buyer journey looks different. Our survey uncovered that the three most important criteria for media buying are brand metrics, engagement KPIs, and ad format. Surprisingly, targeting accuracy doesn’t top that list. Even though advertisers say they are looking to build detailed personas and reach specific audiences, their buying patterns show something different.

Online campaigns typically focus on maximising reach and include a few limited targeting parameters such as age, gender, location, and device type. Third-party data is sometimes used to refine these parameters, but it still doesn’t give ad buyers precision targeting. In short, advertisers aren’t reaching who they think they’re reaching. By proving how first-party data can overcome this challenge, the programmatic ecosystem can encourage advertisers to embrace this data and change how they view its accuracy in comparison to third-party data.

What were the most pertinent market-specific findings from the research? What are the potential reasons as to why UK advertisers are less confident in targeting segments in post-cookie environments?

Advertisers in the UK market rank effective targeting as the most influential element for achieving their KPIs (44%), even though it isn’t considered the most important filter for media buying. Additionally, it’s notable that one in two UK buyers believe accurate targeting is their number one programmatic challenge, but UK advertisers are also 35% less likely to be confident in targeting segments in the post-cookie ecosystem. This is significant, because it either speaks to a ‘better the devil you know’ mentality, or it further emphasises the disconnect between the trust placed in third-party cookies and their actual capabilities.

What’s more, our findings suggest buyers are taking longer to accept the need for change, with almost eight in 10 UK advertisers claiming they haven’t yet implemented solutions for post-cookie environments. Even with the rapidly approaching deprecation of third-party cookies, two-thirds of programmatic buyers consider ad tech, industry associations, and publishers to be responsible for finding these solutions. It seems the mantra ‘if it ain’t broke, don’t fix it’ is still strong in the ad industry, with media buyers not confident enough to try something new, such as relying on first-party data.

One reason behind this could be the misconception that first-party data is simply log-in data. However, first-party data encompasses much more – from contextual information about online content, user interactions with that content, to behavioural analytics, page views per session(s), and site navigation patterns. It can also tell advertisers which ad placements perform the best, who created the content, and who owns the websites where it’s been published. First-party data can not only support more accurate targeting capabilities, but also build greater transparency and therefore confidence in the media buying journey.

How should advertisers adjust their media buying journeys following the deprecation of the third-party cookie? How can they manage this without instigating major (and costly) changes in terms of their buyer platform, billing relationship, and internal resource?

There’s a belief that changing the media buying journey means advertisers will lose all the investment they have put in so far. Instead, the industry needs to frame this change as an opportunity to progress the programmatic ecosystem. This progress is something advertisers must actively shape for themselves, because identifying and implementing solutions will require them to take action.

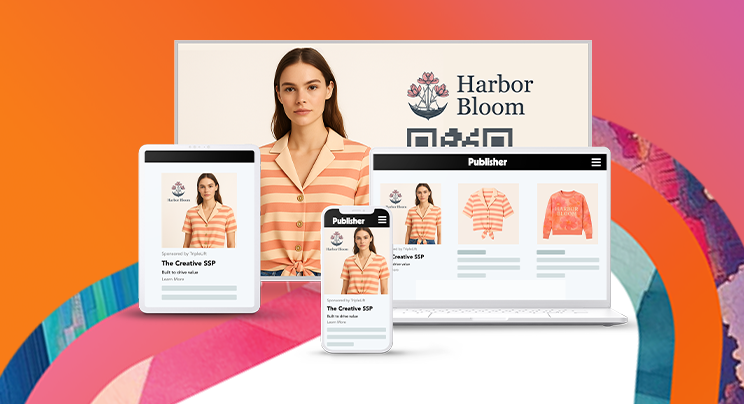

The first step is to work with supply sources that pair first-party data and media together. Advertisers will then need to define audience targeting with their SSP, using a one-to-many — that is, one advertiser to many publishers — deal ID to complement their existing identification strategies. Advertisers will still be able to use their existing buying platform and their billing relationship won’t change. With first-party data, they can scale their digital campaigns across all formats, browsers, and publishers, while also gaining more precise targeting than third-party cookies have previously given them.

What are the likely implications of these findings for the sell-side? How can technology partners and industry associations act to benefit both media sellers and buyers following the deprecation of the cookie?

The upcoming change is unsettling for the whole ecosystem, particularly when it feels as though industry players have no control. As the gatekeepers to online audiences, publishers have a strong opportunity to retain control due to their access to first-party data. No one else understands how users engage with content and what their intent is better than publishers. This deeper view of audiences is valuable to the buy side, as it allows advertisers and their DSPs to reach target segments more accurately.

Technology partners and industry associations must support the supply initiative, so that publishers can develop offerings which meet buy-side expectations. By ensuring these offerings deliver against brand metrics and generate genuine impact, publishers can further strengthen their position in the ecosystem.

Understanding the media buyer’s journey is critical for pinpointing the barriers to adopting first-party data and the misconceptions that need to be addressed. With greater collaboration and education, the ad industry can replace the panic of third-party cookie deprecation with a progressive and optimistic outlook.