Authored by: Caroline Gosnear, Product Marketing Manager

Retail media has become a hot topic in the digital world. But what exactly is it? It’s an umbrella term that describes advertising directly on a retailer’s site or on the open web using a retailer’s first-party data.

How is this new topic gaining so much traction? New buying behaviors are unlocking new budgets, allowing retail media to quickly become one of the fastest-growing ad categories alongside CTV.

This is the first in a series of posts on retail media. Today, we’re covering the basics, but in upcoming posts, we’ll detail what the industry needs to know to win in this new environment— from creative to addressability, and everything in between. So, make sure to keep your eyes peeled for more content in the near future.

Shifting Consumer Behavior

The pandemic changed the way we all consume. For example, services like grocery delivery became commonplace due to shelter-in-place mandates, but have remained popular in a post-pandemic world. With shifting consumer behavior, advertisers must also shift their strategies to meet their customers where they’re spending the most time—and where they are most likely to purchase.

Retail Media Networks also have access to rich first-party data that satisfies the growing demand from advertisers for solutions that do not rely on third-party cookies.

The Potential of Retail Media

Not surprisingly, Amazon is leading the pack, capturing 75.2% of the $45.15 billion US retail media advertising market this year. That’s more than 10 times that of Walmart Connect, the second-largest player in the space. Amazon is expected to see its US ad revenue increase by $5.04 billion this year—more than Google and Meta combined at $3.34 billion. Even with only a few physical stores, Amazon leads due to its diverse offering of data, creative formats, device types, and scale.

Additionally, on the retailer side, retail media unlocks new revenue streams. Joint Business Plans, often referred to as JBPs, now include agreements contingent on spend commitments via Retail Media Platforms. For example, a brand may only have access to seasonally relevant end cap space in-store if they hit their advertising minimums through the retailer’s media network.

Buying online—and, therefore—advertising online is beneficial for both retailers and brands. Rich first-party data makes targeting more successful, driving overall sales. By monetizing their site, they are unlocking ad revenue, driving sales, and providing incremental value for their brand buyers.

Offsite Advertising

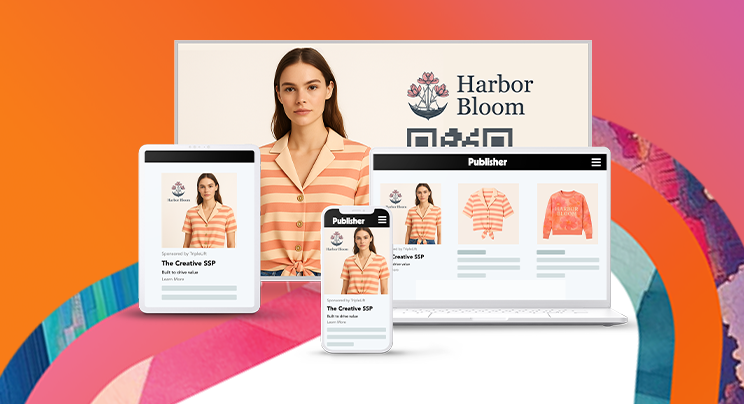

While onsite advertising describes placements available on retailers’ owned and operated inventory, we also see retailers beginning to offer offsite extension in order to add scale and prospect new customers.

Offsite advertising allows the retailer to use brand dollars to unlock upper funnel awareness tactics and influence consumers to view the product on their site.

Offsite ads mostly appear in display placements on non-retail publishers across verticals such as home, food, sports, and technology. The idea is to target consumers as they browse relevant content and drive them to the retailer’s site. For example, home cooks looking for pasta recipes may see a display ad inviting them to the Walmart website to purchase pasta.

Offsite Retail Media’s Growing Pains

Retail Media is still the new kid on the block and offsite is relatively new. While there have been areas of offsite innovation, challenges remain. Currently, brands and agencies are limited in options for creative formats that align with the retail media-specific campaigns, yielding poor user engagement and therefore suboptimal performance. But, stay tuned for the next series installment to learn more about the challenges of offsite advertising and where you should be keeping an eye out.

Retail Media TL;DR

Retail media provides a massive growth opportunity for the entire programmatic ecosystem from brands, retailers, and publishers alike. While Amazon is leading the pack, there is still plenty of pie left to claim in the retail media space, and as more retailers continue to enter the space, now is the time to look for ways to differentiate.

For more great insights on all things Ad Tech, make sure to check out our other blog posts, case studies, and whitepapers.