2020 has been a year of disruption. We have seen almost every aspect of society be altered in some way. This has forced consumers to re-evaluate their day-to-day routines and brands to reassess who they are and how they operate. Here at TripleLift, we have gathered our knowledge and insights to bring you our top 5 trends that will shape the rest of the year and, potentially, beyond.

COVID-19 Escalated Online Shopping Normalcy

From bulk buying to online shopping, COVID-19 has transformed our buying habits seemingly overnight. Online shopping gave consumers access to safe, contactless purchases when in-store shopping couldn’t. Consumers spent 7% more online during the first two months of the pandemic than during the entire 2019 holiday season1. With online retailers working to meet this demand, we expect to see an exponential increase in online spending for the remainder of the year.

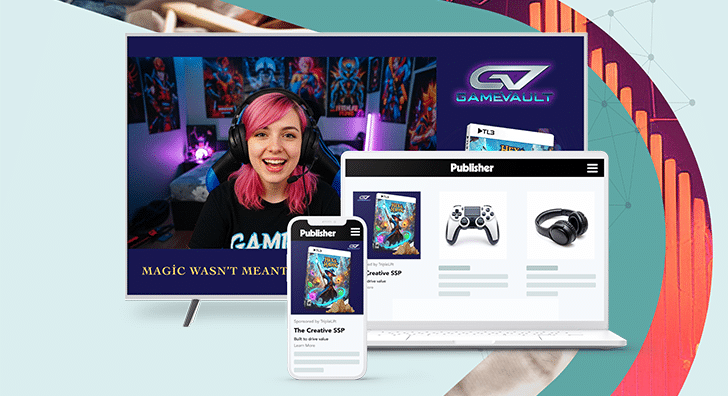

Digital Video Has the Upper Hand on Consumers and Advertisers

As over half of the consumers’ TV viewing time in 2020 was spent on an OTT subscription-based service, advertising inventory has surged 54% YoY. These ad placements have both high viewability and memorability. 65% of people who use a second screen while streaming has looked up a product advertised in a TV show.

Mobile Consumption Continues to Increase Dramatically

It isn’t surprising that mobile use continues to climb, especially with more consumers staying indoors for the first half of 2020. Time spent on mobile phones increased 11% to 7 hours and 31 minutes daily and is expected to remain consistent in 2021. This opens up further inventory while also heightening the competition for consumers’ attention. This rise in activity and heightened focus on privacy will stir things up for advertisers this year.

“Buy Online, Pick Up in Store,” has Won Over Shoppers

Convenience is everything to shoppers — 9 out of 10 choose a retailer based on accessibility. The call for faster delivery times drove demand for “Buy Online, Pick Up in Store,” or BOPIS, over the past few years. In a recent survey, 54% of respondents researched a BOPIS option on most purchases to eliminate shipping time. Once consumers are in-store for pick-up, BOPIS also provides an opportunity to upsell.

Ecommerce Will Incite Holiday 2020 Retail Sales

Holiday sales are expected to increase 3-4% YoY, with eCommerce spend rising by at least 13%, especially with a more significant focus on social distancing. The spend attributed to mobile devices is quickly growing, up 21% from 2018 to 2019, as 81% of consumers said they have purchased gifts on their mobile device. Simple click-through URLs and a streamlined website make eCommerce even more convenient for shoppers.

While the first half of 2020 has seen unprecedented change, learning from consumers’ behavior will help maximize performance during the remainder of the year. Our mindsets should evolve to an online-first approach with marketing and selling while incorporating tried and true advertising methods. Strategizing around these trends will help bolster your 2020 Holiday plan and help discover key learnings for years to come.