Walled garden social platforms like Facebook, Twitter, and Google paved the way for in-feed native ads and normalized them for the modern consumer. Bringing their own audiences, inventory and data, walled gardens initially fulfilled advertisers’ needs, but that also came with a host of drawbacks that negatively impacted ad performance — causing many brands to look elsewhere.

The good news: The future of advertising will thrive outside these walls.

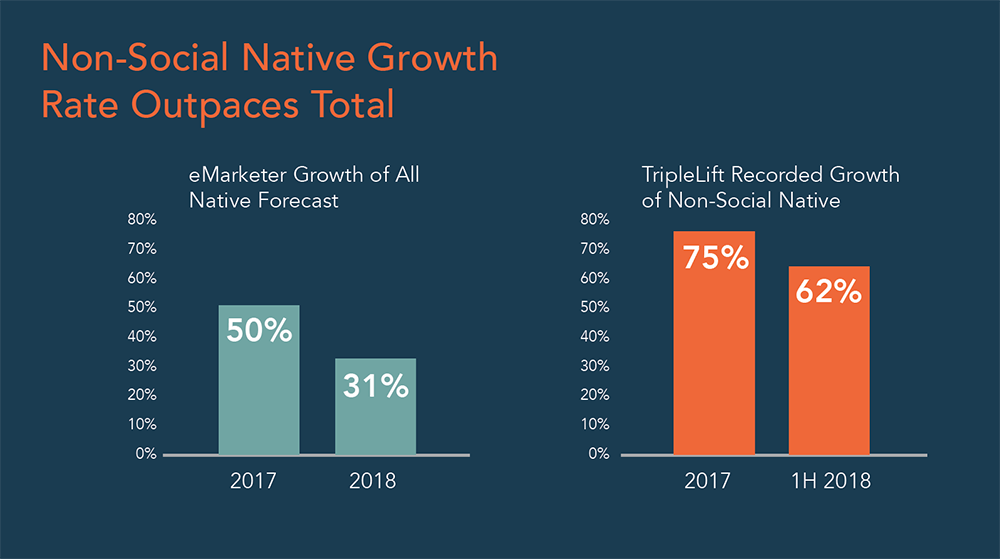

Recent studies have shown that non-social native ad growth outpaces overall native growth. That data inspired TripleLift to conduct our own research and we recently published these findings in our Native Programmatic Trends Report 1H 2018, which includes a study of TripleLift’s first-party data, third-party data including reporting provided to TripleLift, and industry reports and forecasts.

Below, we analyze why social is lagging, why non-social is accelerating, and what that means for your advertising strategy.

Why the Walls Are Crumbling

When considering native ads, there’s a major distinction between social and non-social:

- Social Native displays within walled gardens like Facebook, Twitter, Snapchat, LinkedIn, Google, etc.

- Non-Social Native displays in the open market.

Because walled gardens led to the proliferation of in-feed ads, there’s been a longstanding assumption that they were the gatekeepers to successful native campaigns. But brands quickly noticed how a lack of controls within these platforms also led to limited audience targeting, or their ads appearing next to offensive or irrelevant content.

49% of consumers find advertising on Facebook annoying. – Statista, June 2017

It’s not just brands who are feeling the burn. Anyone paying even a bit of attention to news reels can see that walled gardens don’t have the growth power they once held. They’ve faced everything from data scandals to declines in user growth and engagement across major social platforms. Without a strong and active user base, walled gardens have little to offer advertisers.

Open Markets Offer Fertile Ground

Meanwhile, non-social native growth rate is healthy and growing. A recent eMarketer study showed a 31% total native growth rate in 2018 (19% higher than in 2017). While this is good news for native overall, it’s completely overshadowed by non-social native growth, which showed a 62% growth rate. That’s 2x the overall growth rate. As most digital display advertising is losing value or remaining steady, there’s much to gain from non-social native in the open marketplace for advertisers and publishers alike.

What’s driving this growth?

There are a number of factors contributing to the growth of non-social native.

- Consumer Behavior: Users aren’t engaging less online overall, but rather shifting their engagement from walled gardens to publishers and platforms in the open market that deliver the content they want most.

- Better Ad Controls: Access to premium inventory means better advertising placements and stronger targeting capabilities with genuinely engaged audiences.

- Native Video: New developments in native video led to a 61% growth in non-social native video spend year over year.

- Non-Social Mobile Engagement: As consumers spend more and more time on mobile devices — and more time on these devices than any other — advertising spend on phone and tablets have exceeded spend on desktop.

What does this mean for advertising in the future?

Relying heavily on walled gardens can mean major missed opportunities in the native landscape. Instead, it’s important to consider how native programmatic in the open market can give you the best of many worlds: beautiful in-feed native ads, transparency into placements and data, access to premium publishers and controls over adjacency, and audience quality and diversity. If you haven’t doubled down on non-social native, now’s the time to do so.